The Federal Revenue Service of Brazil (RFB), through its General Coordination of Taxation (Cosit), published, on April 12, the Private Letter Ruling Cosit 85/23 (SC Cosit 85/23), to determine the limits of the restriction on the use of tax Net Operating Losses (NOLs) in situations involving the change of branch of activity by a legal entity submitted to the real profit regime.

The compensation of tax losses, NOLs, of Corporate Income Tax (IRPJ) and Social Contribution on Net Income (CSLL) is subject to a series of limitations in the legislation – lock-limit of 30%, compensation of operating losses only with operating profits, restriction of compensation in case of corporate merger operations, spin-off or incorporation, write-off of the right to compensation in case of extinction, among others. We highlight here the situation that involves the change of corporate control and branch of activity (Decree-Law 2.341/87, art. 32).[1]

According to this rule, the legal entity cannot compensate NOLs of IRPJ and CSLL in case of cumulative change of corporate control and branch of activity. The idea behind this specific limitation is to make it impossible for third parties who did not participate in its generation to take advantage of losses and thus prevent the implementation of corporate operations that aim to allow the use of these amounts in transactions involving acts of simulation and abuse.[2]

The normative provision, however, gave rise to discussions about what would effectively be considered as modification of the branch of activity (for example, adoption of new activity, suppression of core or secondary activity, change of branch of business).

SC Cosit 85/23 is the first formal and binding manifestation of the RFB on the change of branch of activity and its impacts for the purpose of using NOLs credits by taxpayers. The issue had already been analyzed in some decisions of the administrative case law in Carf (Administrative Tax Court of Appeals).[3][4][5]

According to SC Cosit 85/23, the modification of the branch of activity that leads to the write-off (loss) of the right to compensation of tax NOLs of IRPJ and CSLL calculated in the period prior to the modification of the corporate control is that related to the main and core business activity. There is no limitation to compensation in situations where only some of the secondary activities are modified.[6]

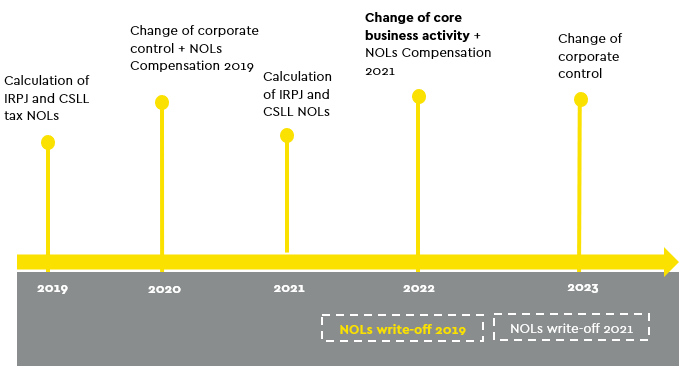

Thus, according to RFB's position in this response to the consultation, if the legal entity has calculated IRPJ and CSLL NOLs and has undergone a change in its corporate control, it will lose the right to offset these credits calculated before the change of control, if it has also modified its activity of a core business nature. There are no negative impacts, however, in case of modification only of secondary activities.

The situation can be represented by the following timeline:

RFB follows interpretations given in similar situations

In our view, the understanding of the RFB is in line with other interpretations already adopted by the body in similar situations. Cases involving the analysis of the application of certain tax regimes linked to the main and core activity carried out by taxpayers.

This is, for example, the evaluation carried out by the RFB on the definition of the application of the so-called "payroll exemption regime", which implies the payment by legal entities of the Substitutive Social Security Contribution on Gross Revenue (CPRB) in replacement of the Employer's Social Security Contribution (CPP-INSS), which focuses on the payroll. In this situation, the taxpayer's framework is linked to the code of the core activity indicated in the National Classification of Economic Activities (CNAE).

In this case, analyzing the correct framing of a corporate taxpayer in the payroll exemption regime from the definition of its core business activity, the RFB understood that the core activity – or preponderant – should be understood as the one that represents the majority of the revenue earned in the previous calculation period or of the expected revenue for the current period – if it is the period of beginning of the company's activities (SC Cosit 106/17).

This understanding ensured the full application of the guidelines imposed by the National Classification Commission (Concla), of the Brazilian Institute of Geography and Statistics (IBGE), for the definition of the core activity in the CNAE (CNAE 2.0 Manual, items 1.6[7] and 1.7).[8]

Although it is recognized that SC Cosit 85/23 is an important manifestation of the RFB on the limitation related to the compensation of IRPJ and CSLL NOLs in cases of modification of branch of activity, we understand that this private ruling does not eliminate the discussion nor precisely delimit the scope of the expression "modification of the branch of activity".

There are situations in which all secondary activities are changed or even in which, due to market opportunity or economic moment, the secondary activity begins to overlap with the core activity, which leads to the need to change the company's CNAE.

These situations are not covered in the SC Cosit 85/23 analysis. Nor should they, in our opinion, trigger any prohibition regarding the use of IRPJ and CSLL NOLs, even if combined with a change of control.

Even with the direction of SC Cosit 85/23, it still seems important to consider the specific analysis of the peculiarities of each concrete case to evaluate the correct tax treatment.

Our team is available to review the understanding adopted by companies on the subject and help define the next steps.

[1] Decree-Law 2.341/87, "Art. 32. The legal entity may not offset its own tax losses if between the date of the calculation and the compensation there has been cumulatively a modification of its corporate control and the branch of activity."; Provisional Measure 2.158-35/01, "Art. 22. The provisions of the articles shall apply to the negative calculation basis of the CSLL. 32 and 33 of Decree-Law No 2,341 of 29 June 1987."

[2] Explanatory Memorandum 169/87, "Article 32 provides for the non-compensation of tax losses calculated by legal entities, when, after the calculation of losses, there has been a change in the corporate control and the company's branch of activity. That rule is intended to restrict the absorption of one legal entity by another for the purpose of compensating for tax losses."

[3] "COMPENSATION OF TAX LOSSES AND NEGATIVE BASIS. CHANGE OF CORPORATE CONTROL AND BRANCH OF ACTIVITY. CUMULATIVITY OF EVENTS. EFFECTS. (...) In the present case, in which the controversy rests only on the occurrence or not of a change of branch of activity, even if the objective elements revealing the questioned change (amendment of the Statute, of classification of economic activity in the CNAE and CNPJ) are disregarded, the data contained in the information statement submitted to the Federal Revenue Service leave out of doubt the occurrence of the fact imputed by the autuante authority." (Carf, Judgment 1302-000.333, August 4, 2010). In this case, the possibility of maintaining tax losses by a company with holding activity (investment in "companies that dedicate themselves: (i) to forestry projects; (ii) the manufacture and sale of forest products, including wood, newsprint, press papers or other types of paper, derived from wood pulp", etc.), which had already been submitted to the change of control and included new activities in its object ("production of press paper, industrialization and trade of wood, management of forest resources"). These new activities were included through the incorporation of other companies of the group, and the holding activity was maintained. As a result of the judgment, in the absence of proof by the taxpayer of the financial preponderance (assets and revenues) of the holding activity in relation to the others, the directors decided by majority (5x1) that the inclusion of new activities in these circumstances would characterize a modification of the branch of activity (holding company for paper production). Consequently, the rule limiting the compensation of tax loss and negative basis would apply.

[4] "I. R. P. J. — MODIFICATION OF SHAREHOLDING CONTROL AND CHANGE OF ACTIVITY — NON-EXISTENCE — Not materializing the imputed tax charge consistent in the cumulative change of branch of activity and shareholder control, does not proceed to gloss of the losses ascertained in previous years by the defendant itself. (...) The incorporation of its subsidiary, (...), on 12/30/94, whose object was insurance brokerage, did not imply a change of branch of activity, since, from then on, it became Rcte. to carry out jointly the activities and brokerage of insurance and interests in other companies, even if in some period of time, in view of the sale of the shareholding and, until the acquisition of a new interest, the income from participations has been temporarily replaced by financial revenues. The sale of the equity interest in (...) occurred in 1996 and the occasional absence of income from participations until the new payment of the capital of (a (...)), as found by the Fiscalização, without alteration of the bylaws, is not capable of changing the corporate purpose of the company." (Carf, Judgment 101-93.760, March 19, 2002).

[5] "COMPENSATION OF LOSSES AND THE NEGATIVE CALCULATION BASIS OF CSLL. INCORPORATION IN REVERSE. WRITE-OFF OF COMPENSATION. BURDEN OF PROOF. ART. 513, RIR/99. (...) If the appellant did not succeed in demonstrating the maintenance of corporate control, nor the absence of a change of branch of activity between the period of calculation of the tax loss and its compensation, the appeal claim does not deserve to be accepted. (...) Based on the ordinance collected above, what is verified is that in fact there was a change in the branch of activity of the incorporating company, with the authorization to operate with capitalization securities, between the date of calculation and the compensation of the tax loss." (Carf, Judgment 1301-005.767, October 18, 2021).

[6] Private Letter Ruling 85/23, "ACCUMULATED TAX LOSS. CHANGE OF BRANCH OF ACTIVITY. The legal entity will not be able to offset its own tax losses if between the date of the calculation and the compensation there has been cumulatively a modification of its corporate control and the branch of activity. The cessation of one of the secondary activities with the maintenance of the other activities already carried out by the legal entity does not correspond to a change in the branch of activity, for the purpose of compensation of accumulated tax loss."

[7] Manual of CNAE 2.0, Introduction to the National Classification of Economic Activities - CNAE 2.0, "1.6 Economic activity and statistical units. (...) Economic activity translates into the creation of added value through the production of goods and services, with the use of labor, capital and inputs (raw materials). The main activity of a statistical unit is defined as its main production process, which contributes most to the generation of added value. In item 1.7 it will be explained how, in practice, the main activity of a production unit must be determined to classify it according to the CNAE. The secondary activity is an activity whose production is intended for third parties, but whose added value is lower than that of the main activity. Most producing units carry out more than one activity and, therefore, have one or more secondary activities. Since, by definition, the unit of production must have a single main activity, in cases where it produces products (goods and/or services) associated with other classes of the classification of activities, these are considered secondary production (...)."

[8] Manual of CNAE 2.0, Introduction to the National Classification of Economic Activities – CNAE 2.0, "1.7 Methods of classification. (...) As recommended by CIIU/ISIC 4, the main activity of a unit with multiple activities is determined through the analysis of the composition of the value added, that is, the analysis of how much the goods and services produced contributed to the generation of this value. The activity with the highest added value is the main activity. In practice, however, data on the value added by individual goods and services are not available. It is recommended, in these cases, that the main activity be determined using an approximation to the value added. The variables used as substitutes for value added can be: on the production side: – the value of the production of the unit that is assigned to the goods and services associated with each activity; – the value of sales of the product groups (goods and services) in each activity. On the input side: – the proportion of people employed in the different activities of the unit – the wages and other remuneration attributed to the different activities (...)."